Your Contract Visualizer

Renegotiate your insurance contracts with confidence

When we renegotiate contracts for our clients, we aim to get $20K – $50K per provider per year increased reimbursement.

- Test dozens of proposed contracts in seconds

- Be certain you’re getting the best RVU schedule for the highest reimbursement

- Accessible by your staff, in-house counsel, or consultants

- Save time and money, simplify an otherwise arduous process

- Compatible with .csv files

- Subscription-based to spread out the expense

FREQUENTLY ASKED QUESTIONS

AKA: Your Free Contract Visualizer Tutorial

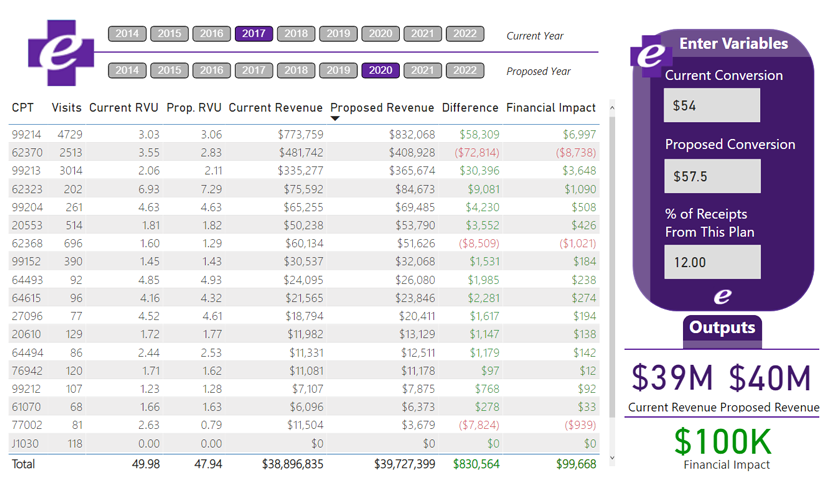

You input your current and proposed RBRVS years and your current and proposed Conversion Factors. Then, you upload a report from your billing system and the Contract Visualizer gives you the financial impact of the new contract. Is it a big raise? Or smaller than you expected? Or perhaps what the insurance company is offering is actually a loss that is packaged to look like a raise on the surface? The insurance companies know exactly what they’re offering you, as they have all of your utilization data.

Clinics have insurance contracts, indicating what they have agreed to accept as full payment for services from some portion of their gross charges. Most insurance contracts are negotiated based on either a discounted price per unit (aka your conversion factor) or a percent of what Medicare will pay (the amount that is published in the annual RBRVS update). In other words, the gross charge amount listed in your billing system and on your accounts receivable report is not the amount you can expect to collect. For most groups, the amount they can expect to collect is somewhere between 30 – 65% of their gross charges. That is dependent upon where their fee schedule is set and how recently their insurance contracts have been renegotiated.

One of the most effective ways to increase income in a medical practice is to review and renegotiate your contracts with the insurance companies in your market. Unfortunately, it is common for clinics to have not reviewed their contracts for 5, 8, or even 10 years. During that time, clinic expenses will certainly increase and if you are not renegotiating your contracts, you are tacitly agreeing to take home less pay each year.

Health e Practices recommends reviewing contracts and requesting a raise once a year. This is because clinic costs are always increasing and the worst thing the insurance company can say is “no.”

Renegotiating contracts annually will alert the insurance companies that you are serious about your business, you are organized, and that you will be back.

If you are not confident doing the renegotiating, hire it out. There are many consultants and attorneys who specialize in insurance contract renegotiations. A few thousand dollars to one of these specialists should net you many thousands of dollars in return. Click here to schedule a Discovery Call to discuss having the Health e Practices team help you with this or select our Concierge level service and we will get started right away.

- When does the contract start?

- How long is it good for and does it automatically renew? If so, we call it an Evergreen contract.

- Most plans have a commercial line of business and one for Medicare and sometimes even one for Medicaid. Be clear about which one you are you being offered. In some instances, you will have a contract for multiple lines of business.

- This specifies how either party ends the contract. Some of these are tricky. Read carefully. This becomes important as you reach capacity and want to “strategically prune” the insurance plans your clinic contracts with.

- Every contract will have one, and this indicates how long you have to submit a claim from the date of service. (The shortest ones we see are 90 days; the longest are 365.) If you surpass this date, they will not pay you. Getting your charges in within a day or two is best practice and assures you will not lose money due to timely filing rejections, so long as your billing team is on top of it.

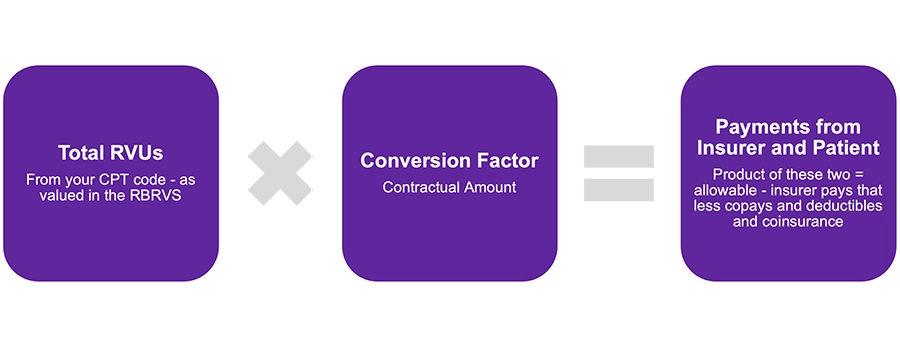

- This is the amount they are going to pay you per RVU. Generally, this is somewhere between $40 – $70 depending on the insurance company, your market, and your specialty. It may also be stated as percent of the current year’s Medicare rate. If so, multiply that percent times the current year’s Medicare conversion factor on the schedule from CMS to arrive at the conversion factor you are being offered.

- This is critical to understanding how much they’re proposing to pay you. The contract will list which year of the RBRVS is being proposed. Each year the Centers for Medicare & Medicaid Services (CMS) publishes a new RBRVS schedule, which lists the Relative Value Units (RVU’s) paid for any given CPT code. These change from one year to the next, so it is important to know which year’s table they are proposing. It is also important to do a weighted analysis using your clinic’s distribution of CPT codes. This is because a shift in RBRVS years appears like a raise on the surface, but may actually be a pay cut.

-

Gag Clauses

- These used to be more prevalent, and we recommend always striking them. This would include any language that precludes you from talking about the plan above and beyond a reasonable confidentiality clause.

- These are required by most plans, and they stipulate that you carry a minimum amount of Medical Malpractice insurance. In many cases this is $1 million per occurrence/$3 million in aggregate. If you have any questions about this, ask your med mal company what the community standard is for limits in your area.

- Note that you do not want to be the highest insured in your community. This only paints a big target on your back in the event a malpractice suit is filed that even remotely involves your practice. Attorneys will always seek out the deepest pockets, and if you carry $3M/$5M in a community where everyone else carries $1M/$3M, attorneys will be focused on your clinic.

- Some plans also stipulate that you carry a minimum amount of general or “property and casualty” insurance. Your insurance broker can help to assure you have adequate coverage in place. It helps to share that section of the contract with them, as some plans have a requirement of what your insurer’s rating needs to be, so your broker can sort that out too.

- This one is especially important for any group planning to transition to concierge medicine, as this is the backbone of that revenue model. Be sure there is explicit language allowing you to offer non-covered services to your patients. Provided that patients know in advance that it is not a covered service, you can bill them directly. Be sure the health plan will not forbid that kind of direct commerce.

CPT codes were created by the Center for Medicare and Medicaid Services to denote all of the services that can be provided for a patient. Each code is five-digits and they describe everything from brain surgery (61250) to removal of ear wax (69209) to a moderately complex office visit (99214). In order to get paid for providing care to patients, CPT codes describe the “what you did” for your patients” on your claim to the insurance company.

Since there are so many different services a physician can provide to patients, Medicare created a system, RBRVS, that assigned a relative value to each service that was listed as a CPT code. This has allowed physicians and medical groups to price their services in relation to one another and based upon complexity and time requirements. Prior to creating the RBRVS, medical services were prices arbitrarily and set differently in each group with little rhyme or reason.

In November or December of each year, CMS publishes an update to the RBRVS for the upcoming year. Raw data files can be downloaded from https://www.cms.gov/ if you want to create your own fee schedule, or our simplified version is available for download in our Medical Money Matters Toolkit.

Each RVU is made up of three components:

- Component 1: Work RVU – this is reflective of the relative amount of work required by the clinician in order to render that service to the patient

- Component 2: Practice overhead of practice expense – this adjusts for procedures and other services that utilize a greater amount of practice resources (e.g., procedure room space or expensive pieces of diagnostic equipment)

- Component 3: Malpractice – this reflects risk involved in any given service and adjusts for those that are much higher risk (e.g., OB/GYN or neurosurgery services)

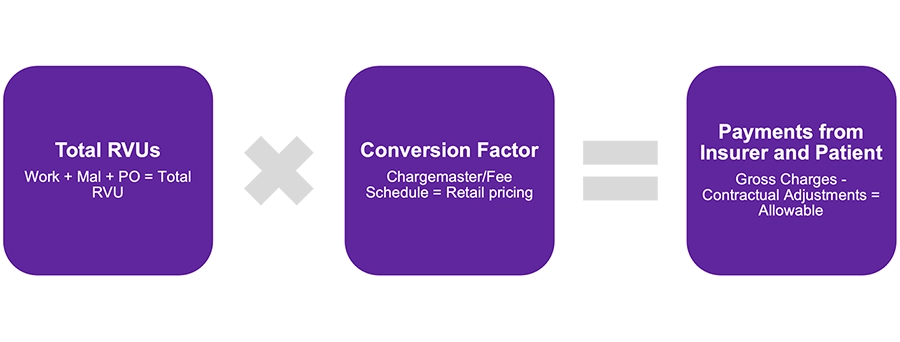

The sum total of these three parts equals the Non-Facility Total RVU, which is the value used to multiply times your conversion factor to arrive at the Gross Charge on your insurance claim.

Physicians and medical groups utilize the relative value units (RVUs) for each CPT to create fee schedules for services rendered to patients. To setup a fee schedule, a group can take the relative value unit ascribed to the CPT code and multiply by a retail price per unit to get the gross charges for a particular service.

Example:

- CPT code = 99213

- Relative value unit ascribed to the CPT code = 2.66 RVUs

- Retail price per unit = $34.61

- Answer: gross chargers for service = $92.06

- Solution key: 2.66 x $34.61 = $92.06

Pro

You’ve done this before – you just need the amazing tool and you’re good to go!

# of Contracted Providers

- 1 - 5$195

- 6 - 10$395

- 11 - 20$595

- 21 - 50$795

- 50+$995

Lite Support

You’d like a bit of guidance from our contracting experts, but you’ll do most of it on your own!

# of Contracted Providers

- 1 - 5$395

- 6 - 10$595

- 11 - 20$795

- 21 - 50$995

- 50+$1195

Includes one hour per month of lite support via email or Zoom (Additional hours billed at $195)

Concierge

You’d like our contracting experts to handle it all and let you know when new contracts are ready to sign!

# of Contracted Providers

- 1 - 5$795

- 6 - 10$995

- 11 - 20$1195

- 21 - 50$1395

- 50+$1595

Includes renegotiating up to 12 contracts (Additional contracts billed at $995 each)

Pro

You’ve done this before – you just need the amazing tool and you’re good to go!

# of Contracted Providers

- 1 - 5$1995

- 6 - 10$3995

- 11 - 20$5995

- 21 - 50$7995

- 50+$9995

Lite Support

You’d like a bit of guidance from our contracting experts, but you’ll do most of it on your own!

# of Contracted Providers

- 1 - 5$3995

- 6 - 10$5995

- 11 - 20$7995

- 21 - 50$9995

- 50+$11995

Includes one hour per month of lite support via email or Zoom Additional hours billed at $295

Concierge

# of Contracted Providers

- 1 - 5$7995

- 6 - 10$9995

- 11 - 20$11995

- 21 - 50$14995

- 50+$16995